P1]

Forecasting, the art and science of predicting future events, is a critical component of effective decision-making across various fields, from business and finance to meteorology and epidemiology. By leveraging historical data, statistical techniques, and expert judgment, forecasting models provide valuable insights that enable organizations and individuals to anticipate trends, manage risks, and optimize resource allocation. This article will delve into the diverse landscape of forecasting models, exploring their methodologies, applications, strengths, and limitations.

Why Forecast? The Importance of Predictive Analytics

Before diving into specific models, it’s crucial to understand the fundamental reasons why forecasting is so vital. Accurate forecasts can:

- Improve Planning and Strategy: By anticipating future demand, businesses can optimize production schedules, manage inventory effectively, and make informed decisions about capital investments.

- Enhance Risk Management: Identifying potential risks and vulnerabilities allows organizations to proactively mitigate negative impacts and develop contingency plans.

- Optimize Resource Allocation: Accurate forecasts enable efficient allocation of resources, ensuring that they are deployed where they are most needed, maximizing efficiency and minimizing waste.

- Gain a Competitive Advantage: By anticipating market trends and consumer behavior, businesses can gain a competitive edge by developing innovative products, tailoring marketing campaigns, and adapting to changing market dynamics.

- Inform Policy Decisions: Governments and policymakers rely on forecasts to make informed decisions about economic policy, public health initiatives, and infrastructure development.

A Spectrum of Forecasting Models: From Simple to Complex

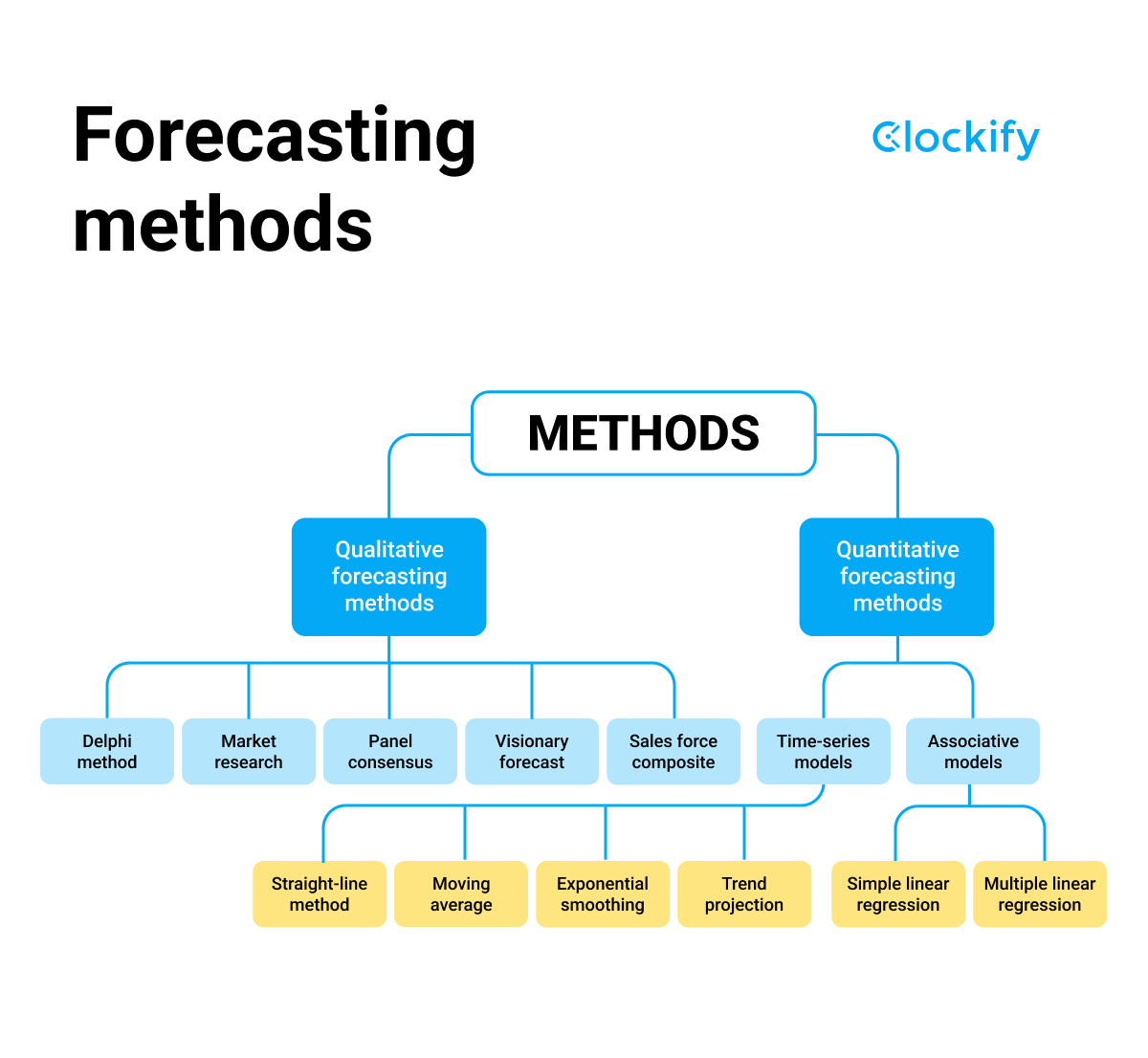

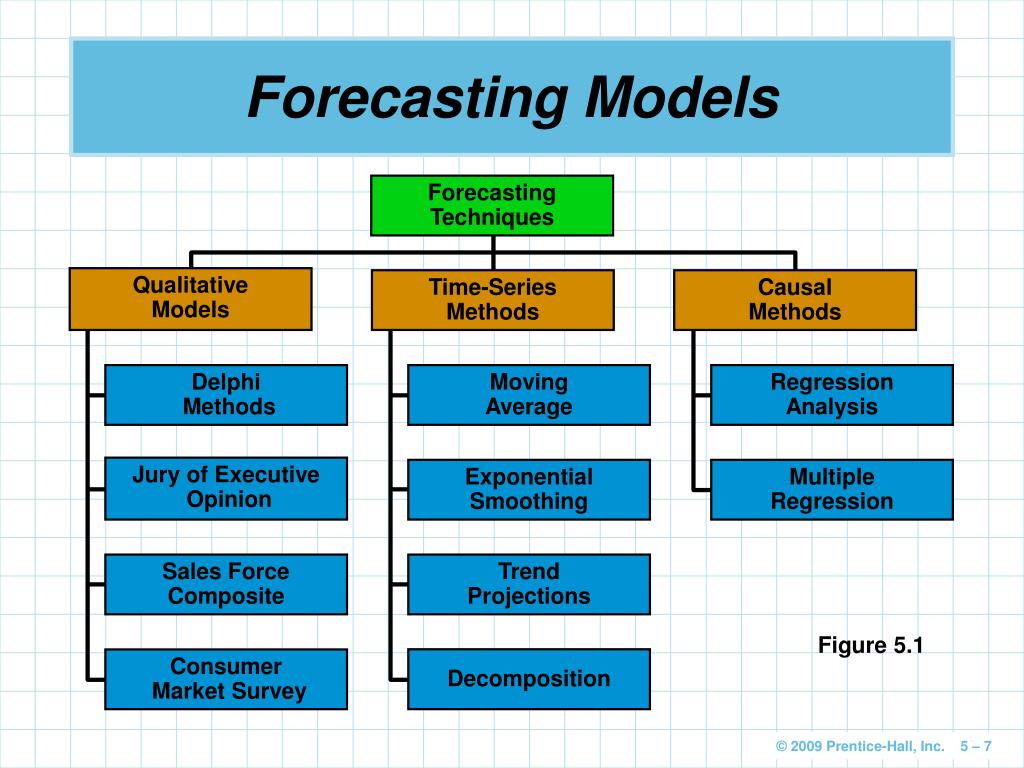

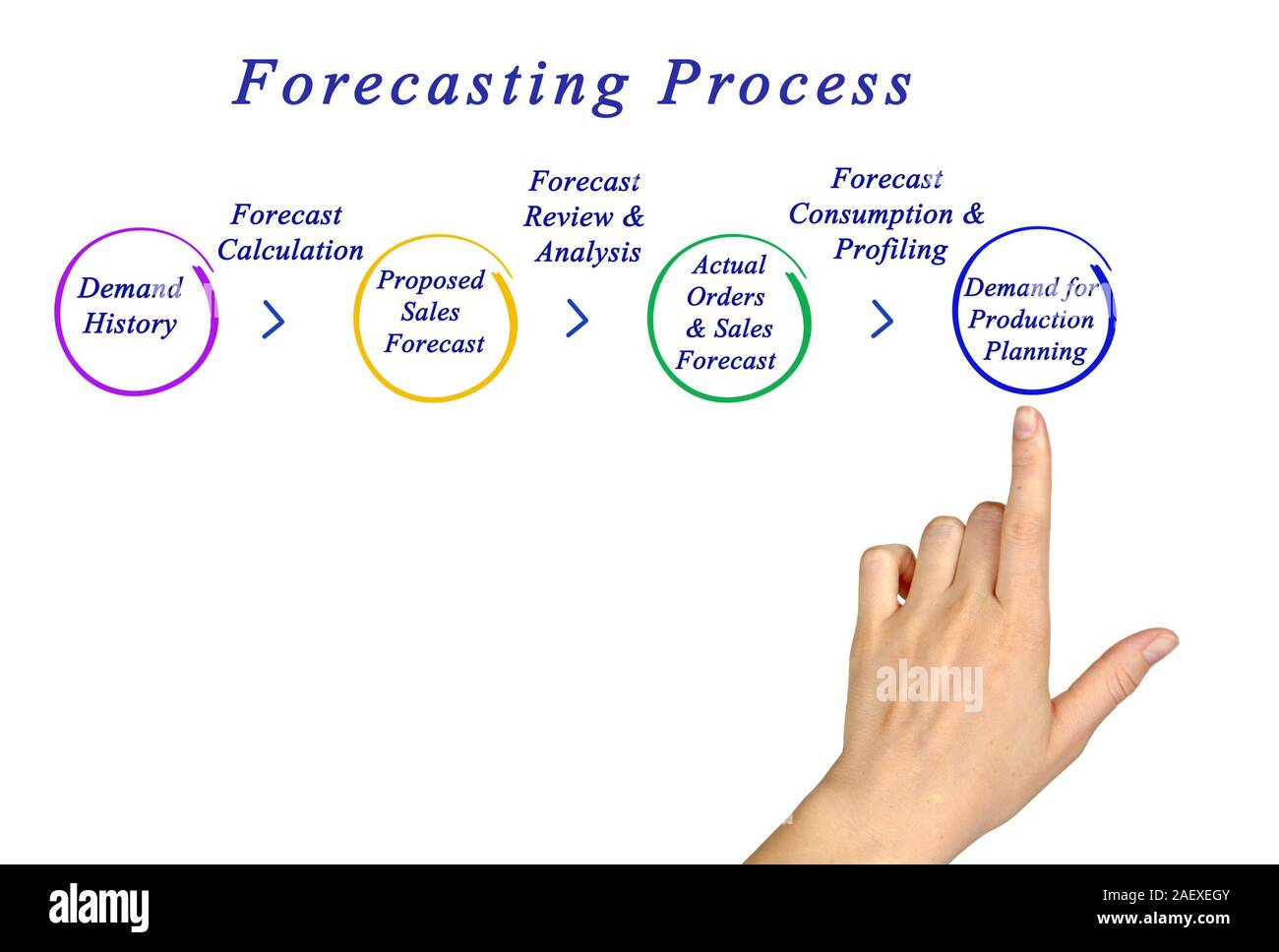

Forecasting models can be broadly categorized based on their underlying methodology and complexity. Here’s an overview of some of the most commonly used models:

1. Qualitative Forecasting:

These methods rely on expert opinions, market research, and subjective assessments to predict future events. While lacking the mathematical rigor of quantitative models, they can be valuable when historical data is scarce or unreliable.

- Delphi Method: This iterative process involves soliciting expert opinions anonymously and then sharing the compiled responses with the group for further refinement. This helps to mitigate biases and encourages consensus.

- Market Research: Surveys, focus groups, and other market research techniques gather data on consumer preferences, buying intentions, and market trends.

- Executive Opinion: Senior management provides their insights and perspectives based on their experience and knowledge of the industry.

- Sales Force Composite: Sales representatives, who are closest to the customers, provide their individual sales forecasts, which are then aggregated to create an overall sales forecast.

Strengths: Useful when historical data is limited, incorporates expert knowledge and insights, adaptable to changing circumstances.

Limitations: Subjective and prone to bias, difficult to quantify accuracy, can be time-consuming and expensive.

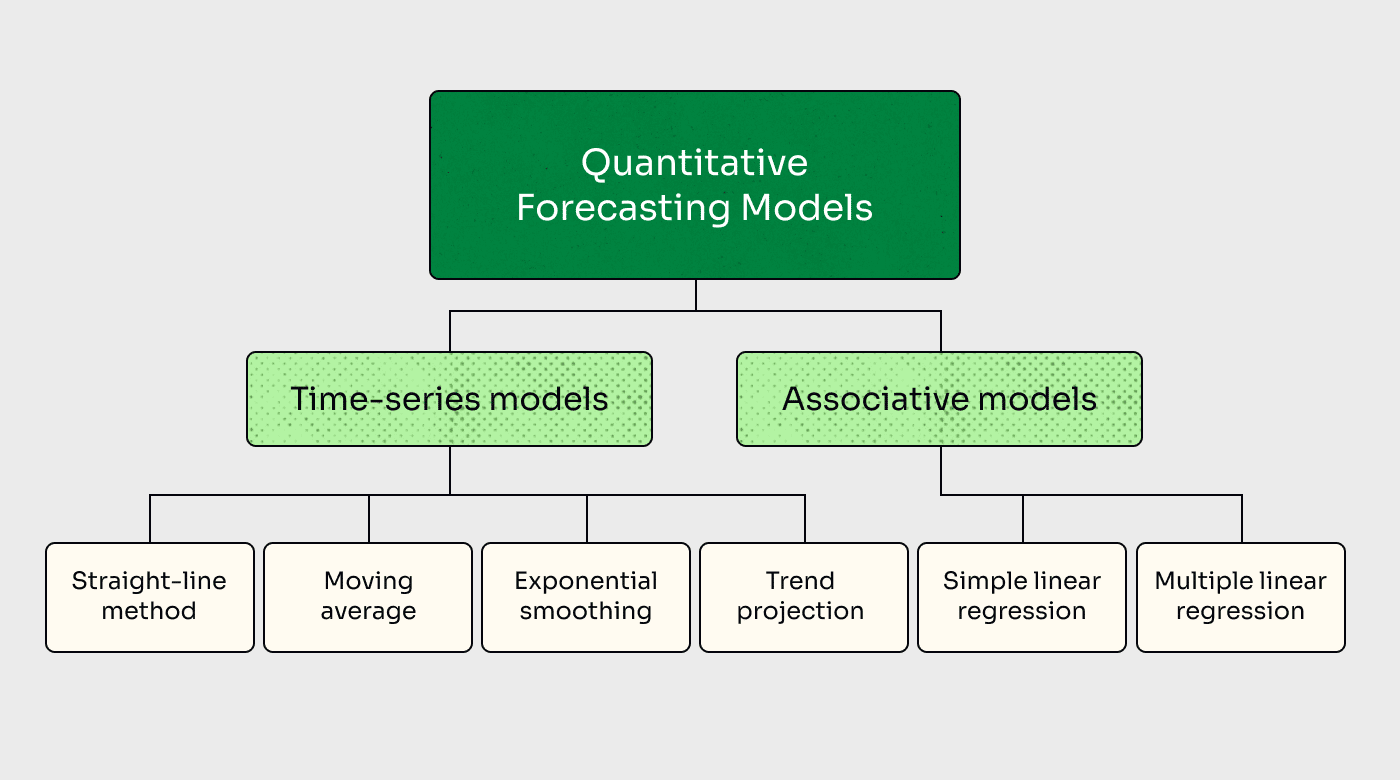

2. Time Series Forecasting:

These models analyze historical data points collected over time to identify patterns and trends. They assume that past patterns will continue into the future, making them suitable for forecasting stable and predictable phenomena.

- Moving Average: This simple technique calculates the average of a specified number of past data points to smooth out fluctuations and identify underlying trends.

- Weighted Moving Average: Similar to the moving average, but assigns different weights to different data points, giving more importance to recent observations.

- Exponential Smoothing: This method assigns exponentially decreasing weights to past data points, giving more weight to recent data. Different variations exist, including single, double, and triple exponential smoothing, which are suitable for different types of time series data.

- ARIMA (Autoregressive Integrated Moving Average): This powerful statistical model combines autoregressive (AR), integrated (I), and moving average (MA) components to capture complex patterns in time series data. It requires careful parameter selection and can be computationally intensive.

- Seasonal Decomposition: This technique decomposes a time series into its trend, seasonal, and random components, allowing for a more accurate forecast of seasonal patterns.

Strengths: Relatively easy to implement, computationally efficient, suitable for short-term forecasting of stable time series data.

Limitations: Assumes past patterns will continue, may not be accurate for volatile or unpredictable data, requires sufficient historical data.

3. Causal Forecasting:

These models identify and quantify the relationships between different variables to predict the value of a target variable. They assume that the target variable is influenced by one or more independent variables.

- Regression Analysis: This statistical technique establishes a mathematical relationship between a dependent variable (the target variable) and one or more independent variables. Linear regression is the simplest form, but more complex models like multiple regression and non-linear regression can capture more complex relationships.

- Econometric Models: These models use economic theory and statistical techniques to predict economic variables such as GDP, inflation, and unemployment.

- Neural Networks: These complex machine learning models can learn non-linear relationships between variables and are particularly useful for forecasting complex and dynamic systems.

Strengths: Can capture complex relationships between variables, potentially more accurate than time series models for volatile data, allows for incorporating external factors into the forecast.

Limitations: Requires identifying and collecting data on relevant independent variables, can be computationally intensive, prone to overfitting if not carefully trained.

4. Simulation Models:

These models create a virtual representation of a system or process and use simulations to predict future outcomes under different scenarios.

- Monte Carlo Simulation: This technique uses random sampling to simulate a range of possible outcomes and estimate the probability of different events occurring.

- System Dynamics: This approach uses feedback loops and causal relationships to model complex systems and predict their behavior over time.

Strengths: Allows for exploring different scenarios and assessing the impact of different decisions, useful for forecasting complex and uncertain systems.

Limitations: Requires a detailed understanding of the system being modeled, can be computationally intensive, results are only as good as the model’s assumptions.

Choosing the Right Forecasting Model:

Selecting the appropriate forecasting model depends on several factors, including:

- The nature of the data: Is the data stable or volatile? Is there seasonality? Are there any trends?

- The forecasting horizon: Are you forecasting for the short-term, medium-term, or long-term?

- The available resources: Do you have the expertise and computational resources to implement complex models?

- The desired level of accuracy: How accurate do you need the forecast to be?

- The cost of errors: What are the consequences of making a forecasting error?

Evaluating Forecasting Accuracy:

It’s crucial to evaluate the accuracy of forecasting models to ensure that they are providing reliable predictions. Common metrics for evaluating forecasting accuracy include:

- Mean Absolute Error (MAE): The average absolute difference between the actual and predicted values.

- Mean Squared Error (MSE): The average squared difference between the actual and predicted values.

- Root Mean Squared Error (RMSE): The square root of the MSE.

- Mean Absolute Percentage Error (MAPE): The average absolute percentage difference between the actual and predicted values.

FAQ about Forecasting Models:

Q: What is the difference between forecasting and prediction?

- A: While often used interchangeably, forecasting generally refers to predicting future events based on historical data and statistical techniques. Prediction can be a broader term encompassing intuition, guesswork, and other non-data-driven methods.

Q: How often should I update my forecasting models?

- A: The frequency of updates depends on the stability of the data and the forecasting horizon. Generally, models should be updated regularly, especially when new data becomes available or when there are significant changes in the underlying environment.

Q: Can I use multiple forecasting models together?

- A: Yes, combining multiple forecasting models can often improve accuracy. This is known as ensemble forecasting. Different models may capture different aspects of the data, and combining their predictions can lead to a more robust forecast.

Q: What are some common mistakes to avoid when forecasting?

- A: Common mistakes include using too little historical data, ignoring seasonality or trends, over-fitting the model to the data, failing to evaluate forecasting accuracy, and not updating the model regularly.

Q: Is it possible to predict the future with 100% accuracy?

- A: No, forecasting is inherently uncertain. The future is influenced by a multitude of factors, many of which are unpredictable. The goal of forecasting is to reduce uncertainty and provide the best possible estimate of future events.

Conclusion:

Forecasting models are powerful tools for predicting future events and making informed decisions. By understanding the different types of models, their strengths and limitations, and the factors that influence their accuracy, organizations and individuals can leverage forecasting to improve planning, manage risks, and gain a competitive advantage. The key to successful forecasting lies in choosing the right model for the specific situation, carefully evaluating its accuracy, and continuously refining it as new data becomes available. While perfect prediction is impossible, the judicious application of forecasting models can significantly improve our ability to navigate the uncertainties of the future.

Leave a Reply